The Weekly Random Walk – November 13, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

Goldilocks and the Various Bears

“Goldilocks and the Three Bears” was a 19th-century fairy tale with three different versions. The original version of the tale tells of an impudent older woman who enters the forest home of three bachelor bears while they are away. She eats some of their porridge, breaks a chair, and falls asleep on one of their beds. When the bears return to their home, she wakes up, jumps out a window, and is never seen again.

The second version replaces the older woman with a young girl named Goldilocks.

The third best-known version replaces the bachelor trio with a family of three bears.

I guess it’s good that Disney doesn’t make a movie of Goldilocks today because lord knows the changes they would make about the characters.

Since the beginning of November, both bond and equity markets have appreciated with a Goldilocks theme of the porridge being “just right” (bulls thesis). This week’s Random Walk looks at why (although markets are appreciating) there are still Bears in this story (bears theory).

Bulls Thesis

Volatility Collapses

After a 10% drawdown from the July peak, equity markets found a floor in October heading into the FOMC meeting last week. After the meeting, the market quickly rallied 6% and continued to climb in November. Interest rate yields also reversed, plunging 20-25 bps across the curve after the Treasury revised its funding needs, and weaker-than-expected data supported the Fed’s decision to keep rates on hold. The market is starting to believe the Fed will no longer have to raise rates, which is why both rate volatility and equity volatility collapsed in the first ten days of trading (the VIX is now back below 15). Implied rate volatility remains somewhat elevated due to large daily swings in options markets.

Short Squeeze

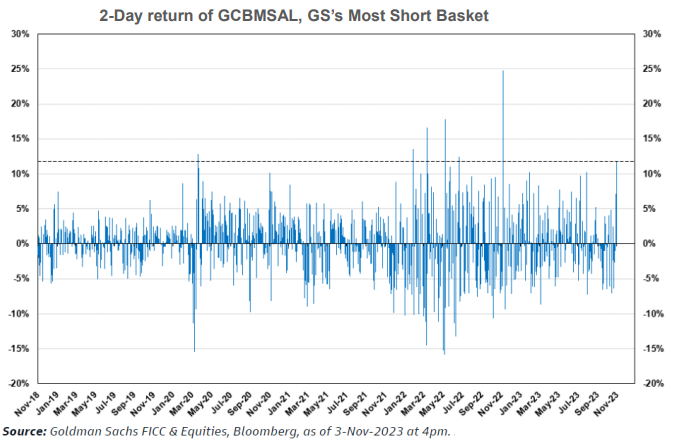

As markets started to rally, those short stocks were getting their faces ripped off. Over the last few weeks, the S&P 500 rose over 5% while the Goldman Sachs basket of the most shorted stocks rose 10%, ranking in the 99th percentile over the last five years (this was a Four Sigma move). Unprofitable tech stocks rallied, meaning money was in buy-the-dip mode, and shorts got beaten up.

As shorts buy to cover, it creates a snowball effect, helping stocks rally further.

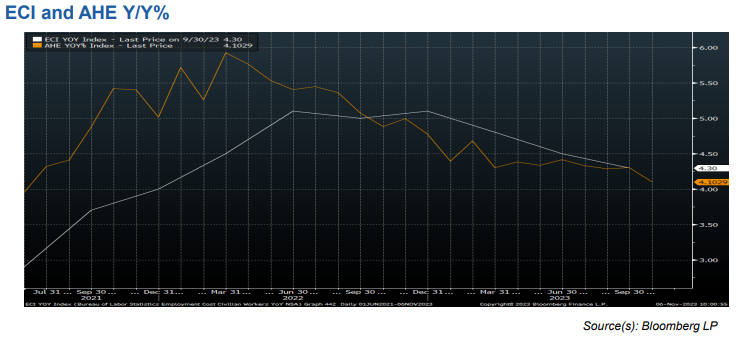

Wage Growth Decelerating

Wage growth is one of the most significant data points the FOMC looks at when evaluating the potential for future inflation. On this front, the Fed is seeing wage growth decelerate, thus making it easier for the Fed to stop raising rates. Last week, Chairman Powell commented on this by saying, “So if you look at the broad range of wages, increases have come down significantly over the course of the last 18 months to a level where they’re substantially closer to that level that would be consistent with two percent inflation over time.”

He is correct in that statement; however, we are unsure if the decline in wages is due to a release of unemployment pressure (as the unemployment rates come up back towards 4%) or if various strikes (UAW, Actors, etc.) are helping do the Fed’s work.

PCE and CPI Inflation Set to Diverge (Again)

The BLS (which reports the CPI data) has derived healthcare services inflation annually from insurance companies’ retained earnings (premiums less benefits). That has led to wild swings in healthcare inflation in the CPI, especially post-COVID. Starting with the October CPI, they will frequently update retained earnings to smooth this impact. This will smooth the CPI series and bring forward the correction from last year’s decline. This methodology change should add 45 bps to the year-over-year (Y/Y) core CPI for the following year. Core PCE should be relatively unaffected due to different methodology and scope.

Oil Prices Drop

Oil prices declined last week to their lowest levels since August amid a medley of factors.

West Texas Intermediate (WTI) shed 2.2% last week, falling to $79.08 a barrel, while Brent Crude moved lower by 2.1% to $83.39 a barrel (in September, it was near $100). Energy traders we spoke with have shrugged off the risk premium of a prolonged war, regional oil supply issues, and potential spillover effects.

A global market showing signs of a slowdown is part of the price pullback. China’s economic growth has faltered for months, with little sign of recovery in the near term. Higher interest rates in the US now have the “lag effect” the FOMC hoped for as economists continue to see a slowdown in consumer spending.

We believe that OPEC+ and Russia will maintain their oil supply cuts until the end of the year (based on comments by officials), and if prices were to drop into the low 70s, they could announce even more significant cuts. We like the commodity at these levels, and we believe it acts as almost a hedge against the Middle East with potential expanding conflict.

For equity and bond markets, it’s a Goldilocks moment because it eases pressure on PPI and CPI, thus helping the Fed hold at its December meeting.

Three Bears Thesis

Debt and Cost of Capital

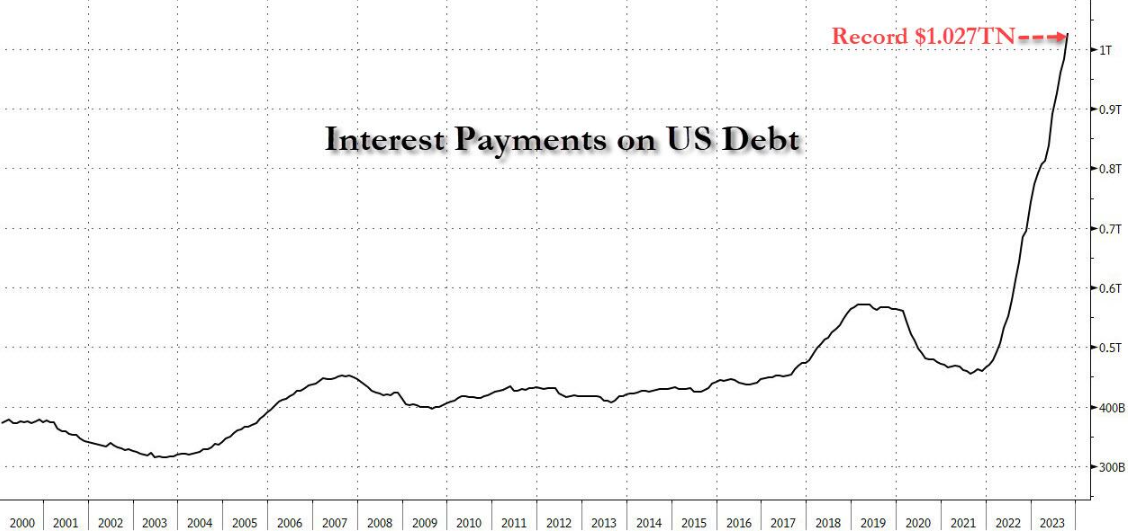

As lawmakers continue to ignore the horror show that is the US budget, the US has now hit an interesting delta as US debt interest payments just hit one trillion dollars.

Last week, the Treasury (quietly) released their report in which, by their calculations, total interest is now at 1.027 trillion dollars annually. This calculation by the Treasury is real-time interest cost- based on Treasury data – different from what the Treasury paid. Interest costs in the fiscal year that ended September 30 totaled 879.3 billion, up from 717.6 billion in 2022. That number lags behind the pro forma print and will inevitably catch up to it. It then lags on the other side even as pro forma interest payments start dropping (once the Fed starts to panic and lowers interest rates).

If you’re a fan of exponential functions (like we are), you’ll be happy to know that with the surge in rates and interest expense in the past two years, the US interest has doubled since April 2022. What makes our hearts drop into our stomachs is all happening with the vast majority of 5,7, 10, and 30-year debt still locked at lower rates. Since the Fed did not issue longer debt when interest rates were low (instead issuing short Treasuries at next to zero interest levels), the US will face great expense in the future when this debt rolls off.

Last Thursday, we saw a primer of what we think will be a bigger issue in the coming years as the 30-year auction as the bid to cover was a mere 2.236. Foreign bidders were the lowest since 2021; directs only took down 15.2% of the auction. Dealers were forced to step up and take the balance, a whopping 24.7% of the auction. Equities went from green to red following the poor showing.

The continued mismanagement of US resources (aka taxpayer money) should be enough to get every lawmaker kicked out of office. Instead, we continue to hire fiscally irresponsible representatives who will bankrupt this country.

Hibernation

Despite fiscal irresponsibility from DC, we continue to believe interest rates across the curve will be lower 12 months from now. Our reasoning is simple: a mild recession forces the Fed to lower short-term rates to stimulate the economy.

However, as we rally in bonds, we believe that many institutional clients who own long-duration bonds will look to sell holdings at higher prices. Banks and insurance companies that bought bonds at lower rates are holding underwater mark-to-market bonds, and we believe they could sell into a rally (even if they don’t break even).

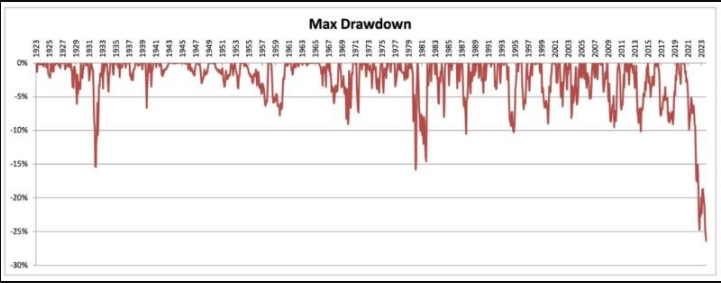

The new “bond guru” Jeff Gundlach, was interviewed and said, “We like long-term treasury bonds for the short-term trade going into recession. The 30-year US treasury yield downtrend of the past four decades has completely reversed, skyrocketing nearly 400bps in under two years. There has been about a 50% drawdown in the long bond, which means there is now potential for the long bond to increase in price.”

Higher yields have acted at defacto rate hikes for the Fed. This is why we believe the Fed has turned dovish going into its December meeting and making things for them in the near term. We have been buyers of bonds with maturities of no more than four years with an average duration of about 1.8 years for the simple fact that once “trapped longs” sell, buyers will stay on the shorter end of the curve as they continue to watch Washington waste money and auctions continue to increase in size. Once the debt loop spiral starts, it isn’t easy to stop.

The Porridge Got Cold

After several months of inconsistent reports on US Household Debt, the Federal Reserve published September numbers, and we found some of the data rather interesting.

Consumer debt increased by 9.1 billion in September, down from August’s 15.8 billion. In early 2023, consumers were adding 20-30 billion per month.

Credit card debt rose by just 3.1 billion, the lowest increase since 2020.

Student and auto loans also slowed to just 5.9 billion, the lowest increase since 2020.

It appears that consumers have maxed out their revolving debt (credit cards) because the personal savings rate also collapsed from over 5% to now under 3.4%.

Lastly (and this is the big one), the Fed reported that the AVERAGE rate on credit cards across US financial institutions hit a record high of 22.77%!

Consumers may fall into a debt spiral before the Government, but it appears only a matter of time before the US GDP prints go negative now that the consumer seems to be on the edge of cracking.

Don’t Jump Out of The Window – Bullet Points

Unlike the first version of Goldilocks, there is no need to jump out of the window. As discussed last week, we are on the brink of significant transitions on multiple fronts (some we like, some we don’t); with that being said, here are some quick points this week.

The S&P 500 is above its 50-day moving average (DMA) but seems to run into resistance at its 100 DMA at around 4400. Until Thursday, the market was on a nine-day “hot streak” and a little overbought. We believe the S&P channel is in place, and the market is slowly progressing higher by the end of the year. We believe 4400-4500 is possible.

Next year is a different (earnings reset) issue, but more on that in the coming weeks.

Our friends who gave us grief about various ESG and alternative energy issues should look at multiple articles recently as the MSM is finally admitting what we have explained from the very beginning: cost and lack of infrastructure means that fossil fuels are needed. Those stopping pipelines or exploration are taking the economy down an unsustainable path.

Speaking of alternative energy, Tesla is an excellent example of how alternative transportation is working (or not working). The company is reporting profit compression because (surprise) most can’t afford a $100,000 car. Ford and GM are losing billions on their EV projects. Car makers have excess EV inventory they can’t move, and we will watch (with our popcorn) as we predict price wars soon.

(Disclaimer: we want a clean environment, but our argument has always been rushing to alternative energy or EVs by 2035 was foolish).

NO UPDATE NEXT WEEK. WE WILL RESUME ON THANKSGIVING WEEKEND AFTER STUFFING OUR FACES!

Trade carefully. Thank you for listening.

Have a great week.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.