The Weekly Random Walk – October 30, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

The Halloween Edition – Boo!

On Tuesday will be All Hallows’ Eve, observed in many countries, a day dedicated to remembering the dead, including saints (hallows), martyrs, and all the faithful departed. Some parents (including this one) called October 31st “All Cavity Day” since the amount of candy our children would bring home would make the dentist happy.

After Halloween, the “Switch Witch” would empty most (but not all) of the children’s candy but switch it with a toy or a stuffed animal (except for candy the parents liked…just saying), thus keeping the dental bill down to a minimum.

Like the children coming to our door in various Halloween costumes, this week is a random amount of data. Some of which is a trick and some of which is a treat to the economy and markets.

First Costume – Saudi Prince (Oil)

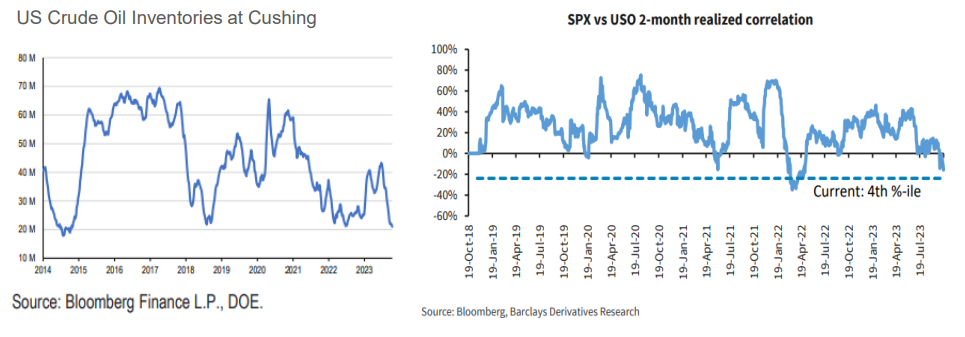

WTI is stuck in a trading range like equities. Oil prices have risen over the last few weeks while the S&P 500 has decreased. This has led the correlation between oil and SPX to negative levels, and are now at the 4th percentile over the last five years. The curve remains in steep backwardation, suggesting that the market has low concerns regarding longer-term movements in oil prices. However, this negative correlation may persist for some time, with US crude inventories very low (see chart below) and the SPR at the lowest level since early 1980.

We are observing tensions in the Middle East, as any outside involvement by countries, including the US, could restrict supply further, and we could see WTI back above 100 dollars per barrel reasonably quickly. This could have a widespread economic impact and continue to make inflation very sticky.

Second Costume – Roofer (Homes & Mortgages)

As discussed in last week's update, the relentless rise in long-term rates pushed 30-year mortgage rates above 8% for the first time since 2000. According to Redfin, the average monthly mortgage payment is climbing to nearly $ 3,000 per month, so the typical homebuyer needs to earn roughly $115,000 per year to afford a home. This is twice the average annual national salary ($59,428). As a result, mortgage applications continue to fall.

Third Costume – Treasury Secretary (Treasury Bonds)

Long-end Treasury yields pierced 5% before slipping back into the high 4s this week. The steeping of the curve over the last two months has been very painful for bond investors, especially with the positive correlation between bond prices and stocks. The breakdown in market technical(s) has caused a spike in realized volatility. The ten-day realized volatility on the TLT topped 30% last week, the highest level since the start of 2023. Despite the dramatic sell-off, the yield curve remains inverted, suggesting more room to bear steepen and take out Fed cuts priced into the market.

Despite the 10Y returning below the 5% mark, Treasuries may continue under pressure as US households become buyers of last resort in Treasuries. As discussed last week, other sectors (institutional and sovereign funds) are reducing their Treasury exposure; this leaves households as the only net buyers (either through individual bonds, ETFs, or mutual funds).

Households have historically been the smallest holder of Treasuries, but in less than two years, they have increased their holdings by 1.7 trillion, taking them to a new high of 2.4 trillion. The way things are going, households may end up owning a lot more – but they are likely to demand a greater yield (some estimates say another 150 bps) than currently on offer to compensate for the risk.

US banks have been reducing their exposure to duration through Treasuries. Before the Fed started hiking, Treasury holdings of banks had reached all-time highs. However, banks typically reduce their UST exposure when rates rise.

Since the Treasury Secretary (Janet Yellen) is so realistic, she gets a lot of candy in her bag. So, one more treat on that front.

The weighted average maturity (WAM) of the coupon sector of the Treasury market is currently the highest since 2001. The overall WAM of Treasury debt hasn’t moved higher of late due to the surge in bill supply in recent months. However, the steady rise in WAM coupon debt is likely another source of the supply-related concerns that have afflicted the Treasury market recently.

This is a big deal and something to observe. We have been pounding the table about the need for fiscal responsibility from lawmakers in Washington. The reason is that at a certain point, the US could fall into a “Fiscal Doom Loop.” Government spending is up 14% YOY, and tax receipts are down 7% YOY. Higher interest rates (needed to slow inflation because of the government printing money) compound this fiscal irresponsibility. Once it begins, this “daisy chain” is complex and challenging to stop.

We are starting down that rabbit hole with little from Washington to stop it.

Fourth Costume – Grim Reaper (Debt)

We will start with the bad news and end with some good information before moving to the bullet points.

The US Federal Government added 600 billion in debt last month and borrowed 10.47 trillion dollars since the Covid outbreak in Q1 2020. This is now compounding at higher rates, and with our “support” of various war fronts, fiscal austerity seems like a pipe dream.

Meanwhile, the retail credit card APR average just hit 28.93%. Consumers are likely also to feel the effects of a debt spiral because we know the American Consumer rarely uses fiscal austerity for their finances. To make matters worse (this is the Grim Reaper), US credit card debt outstanding just exceeded 1 trillion dollars! Gulp….

One last bit of information that is frightening before we move to the last costume is the average portfolio performance.

As discussed in prior updates, most retail and institutional clients have diversified portfolios, and when looking at the S&P cap-weighted (driven by seven stocks), it’s outperforming the equal-weighted (more like a diversified portfolio) by 13% YTD. That is the widest margin of outperformance (through this part of the year) in 30+ years.

Since yields have gone higher, we are now in year two of balance portfolios being down (last year, they were down 16%, and this year, they are down 4%). This leaves investors one of three choices: 1) get out (which is a mistake), 2) load up on the large-cap tech names driving the index (also a mistake), or 3) be “Job” like and know that in the 1970’s the market traded similarly until it broke free and moved higher. None of us knows when that will happen, so it’s best to stay put and continue with a diversified strategy.

Last Costume – Unicorn (End Of Year Trading)

With all of the headwinds hitting the equity market – there is at least one positive point to make in favor of the bulls over the next two months: seasonality. Historically, the last two months of the year provide the highest positive returns, particularly in small-cap stocks. Looking back over the previous twenty years, we are right at the inflection point where the equity market tends to drift higher into the end of the year. In December, we call it “The Santa Claus Rally.” Hopefully, he hasn’t put Washington, the FOMC, or any of these other knuckleheads on the naughty list and provides a gift to investors this year.

Hand Over the Candy – Bullet Points

Since early 2022, we have seen one of the most prolonged bouts of bond-stock price correlation we can remember. Other than two months this year, bonds have not offered a “safe haven” to equities. Investors are getting frustrated as most see red on their statements no matter what asset they invest in (except for some alternative strategies, SPY and QQQ). We wonder if we will see capitulation by investors in 2024 as frustration leads to panic selling.

The war in the Middle East continues to intensify, and the potential repercussions, both human and macro-economic, are worrisome. Each week, we look for the positive in markets and economies, and it has not been easy to find. Yes, I believe there is a cyclicality to the market that will lead equities higher into the end of the year. But trying to get beyond 2024 and investigate next year is challenging with so much uncertainty.

In the last few years (other than the two months during COVID-19), we have not seen the capitulation needed to flush the markets clear of speculators. As a result, we are getting markets whipped around on any/all news. It is frustrating to folks like us in the portfolio management business. Go up or down, but this endless range bound up and down-market forces patience not used since we had to go shopping with our teenage daughters.

We would fade any meaningful rallies in equities over the next few months and rebalance to cash and fixed income into 2024 (note: this doesn’t mean to come out of equities, rebalance, or reduce depending on portfolio risk). That’s the best crystal ball moment we have right now unless something changes.

Trade carefully. Thank you for listening.

Have a great week.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.