The Weekly Random Walk – February 5, 2024 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

Threading The Needle

We have all heard the term “threading the needle,” which has multiple meanings. The literal meaning is to guide a piece of thread through the eye of a sewing needle. We are using its social meaning to navigate through a challenging situation skillfully. Specifically, we will continue to look at how the Fed has various data points to determine potential rate cuts and the economic outcome.

Election Year – Market Focus

With the Democratic and Republican candidates almost set, the countdown to the election begins. This November will be unique because five candidates may be on the ballot. According to prior pre-election periods, markets start to care about the results (polls) around mid to late March. Since World War II (and focusing on the two main parties), the S&P 500 has, on average, performed better in an election year when the incumbent was a Democrat, returning around 10% on average (disclosure: past performance does not guarantee future returns). By comparison, the average return for the market when a Republican was the incumbent was around 4%. So, if history repeats itself, this year could be favorable to equity investors.

Top Heavy

S&P 500 leadership continues to be propelled by the mega-cap tech names, with the Magnificent Seven off to another great start this year. Nvidia, Meta, Microsoft, and Google are all up double digits in a little over one month. The one notable exception is Tesla, which fell 25% in January. Last week, Telsa lost 12% in one day after the company warned of slowing growth in electric car sales and the existential threat from Chinese rivals.

The stock that has had the biggest gain is Nvidia. As you can see by the chart, the stock has gone up like a Saturn Five rocket and is way above its 100 DMA. The momentum indicator on this stock is at a fourth-sigma level and would seem, to us, unsustainable. We sold a prominent position in the stock this week, and we hope we have the opportunity to repurchase it at lower levels because we like this stock long-term.

Small Caps Have Not Followed

As the S&P 500 hits new all-time highs, small caps (Russell 2000) are still 19% below their highs set in 2021. There are many possible explanations for the underperformance of small caps, but one undisputable fact is the decline in EBITDA over the last couple of years. Since the old high in 2021, EBITDA dropped from just under $200/share to $171/share or roughly 15%.

Equity Valuations Are All Over The Place

The rally over the last three months has led to valuations (P/E multiples) in sectors such as information technology and healthcare to the 100th percentile in the previous ten years, while interest rate sensitive such as utilities are at the 2nd percentile. Big tech is now at the 81st percentile as earnings estimates continue to grow in that sector, in contrast to healthcare, where earnings are expected to fall.

Fixed Income Issuance

Investment-grade companies wasted no time in January taking advantage of the drop in interest rates to replenish corporate coffers. Through the middle of January, high-grade borrowers tapped the market for 150 billion, the most to start a year going back to 1990. Microsoft is rumored to bring a large debt deal to market within the next few weeks, but spreads remain extremely tight despite that.

ESG

One of our favorite websites is Visual Capitalist. They have some fantastic charts, and this week was no different when they highlighted that ESG investments had lost their shine as the flow into funds has slowed, the political backlash continues, and examples of greenwashing continue to hit the news.

The chart below shows the drop in fund flows, often considered an indicator of investor sentiment based on data from Morningstar. In 2018, we were a record (in writing) of promoting ESG-type funds purely on flow. In 2021, we urged caution after Tariq Fancy's (former CIO of Blackrock’s Sustainable Investing Group) paper, which pulled the curtain back on how asset managers used ESG as a marketing ploy to capture more significant fees. This began a daisy chain that worked its way to State AGs and Capitol Hill.

Now, it’s become a political hot potato (both sides), and it’s of little surprise to us that “ESG” is in decline. It’s a shame because true impact investing is noble, as we should be good stewards of our communities and the planet.

Jobs – Economy Focus

Last Friday, the headline was a blockbuster jobs report. On the surface, the BLS reported that the US unexpectedly added 353K jobs in January. This was almost double the consensus forecast of 185k expected (a four sigma beat). These numbers are a slap in the face of the Fed’s disinflation narrative, and Fed Funds immediately shifted from cuts in March to moving out to May (no surprise to us).

However, after digging into the number, two things make us think this report is not as robust as it seems. 1) BLS decided to slash the estimated hours everyone worked from 34.3 to 34.1. This doesn’t seem like a lot, but it dramatically affects the hourly earnings jump (making it look like wages went higher). No reason was given for why they cut the hours. 2) The BLS reported that in January 2024, the US had 133.1 million full-time jobs and 27.9 million part-time jobs. Well, that’s great until you look back one year and find that in February 2023, the US had 133.2 million full-time jobs or more than it did one year later. So, when you dig into real job growth, it becomes clear it’s coming through part-time work.

On top of that, these numbers may not hold with significant layoff announcements from firms like UPS (cutting 12,000 jobs), eBay (cutting 1000 jobs), Twitch (cutting 35% of its workforce), Activision Blizzard (cutting 1,900 jobs), etc. We think the job market is not as robust as one would think by the headline number this week.

Food Inflation Continues to Rise

Beyond a significant headline number, the Fed must look at the food prices and be unhappy about continued consumer increases. Cocoa prices climbed to a 46-year high last week on concerns dry conditions across West Africa could reduce yields for the Ivory Coast (so go by your M&Ms now).

Good luck buying a steak when the weather gets warm because, in the US, we are seeing a rapidly shrinking cattle herd (thanks to regulations of cow flatulence via the environmentalist…not joking), now at the lowest level in seven decades. This has pushed the price of beef to a record of $5.21 per pound.

Overall, food inflation has slowed, but pockets are starting to show signs of reacceleration, making cutting rates a much harder decision since food is a staple of CPI.

Regional Banks Struggle

Regional banks are acting as two left thumbs for the Fed, trying to navigate rate cuts.

Last week, regional banks were under pressure as banks sold off as investors have grown cautious of the sector’s sensitivity to high(er) Federal Reserve interest rates. As rates remain high, banks of all sizes are dealing with commercial real estate (CRE) portfolios that are losing value, and in some cases, lenders are turning back the keys.

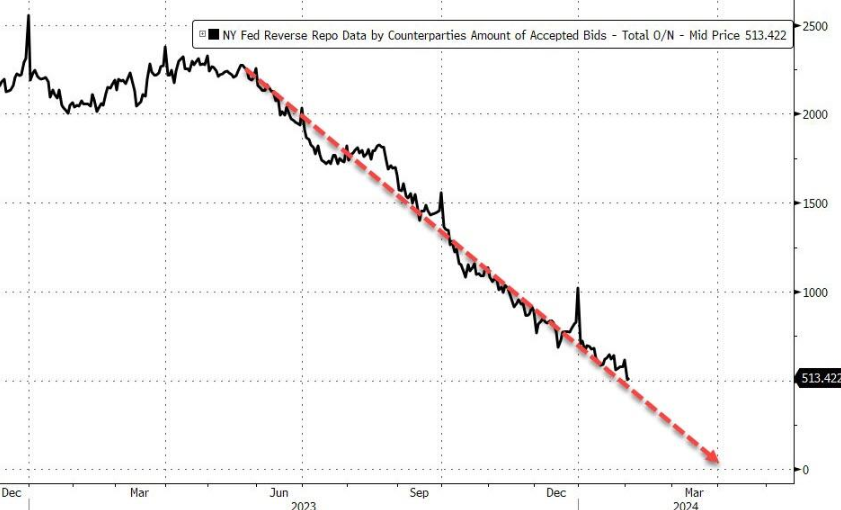

As a result of equity prices, money market funds saw over 42 billion inflows, sending money funds above 6 trillion for the first time. This money comes mainly from regional banks, now going to the Fed’s reverse repo facility, which saw a continued drawdown and only has 500 billion dollars left.

As the US equity market cap remains decoupled from shrinking reserves, one has to wonder who is right. Those who are going “risk on” buying equities at all-time highs or continue to put money into MMFs and staying “risk off.”

Singer Sewing Machine (Bullet Points)

For those old enough to remember what a Singer sewing machine looked like, this model we saw in our house as a kid. Back then, moms were terrific about putting hems on bell-bottom jeans that were way too big for us (just saying). Here are some quick thoughts as the Fed stitches to cuts later this year (you’re welcome).

This is still a data game I heard Chairman Powell say multiple times last week, “The data is good” or “It’s not that the data hasn’t been good.” Still, we need more of it because it’s inconsistent with a single narrative on where the economy and inflation are headed.

The most significant risk, in our opinion, is the Fed not being able to get inflation down to 2% and it stabilizes meaningfully higher. This has been our opinion since last year based on history because unless you pull the economy into recession, the economy's resiliency makes hitting a 2% target very difficult. The idea of a “soft landing” never made sense to us. Either live with inflation at 3-3.5%, or the economy goes into a recession cycle to reset. That needle is almost impossible to thread.

Some of those on TV (who will remain nameless) last week talked about Powell’s comments after the FOMC as being hawkish. We disagree. Yes, he took a March cut off the table, but this is about timing, and, as we said earlier, it’s about data. The Fed has made so many mistakes over the last twenty years I give the FOMC credit for trying to allow data to dictate the pace.

Lastly, the equity market, by all measures, is well in the overbought category. Big techs are ripping higher, and there seems to be no end in sight until momentum changes (and it will). Resistance is likely at 5,000 on the S&P, but it wouldn’t surprise us if we punched through. But at that point, valuations (P/Es) make no sense (in our opinion). We may be early, but we would use that opportunity to take some money off the table (note: this would be for trading accounts and not for long-term investors). We are in rarified air at these levels.

Trade carefully. Thank you for listening.

Have a great week.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.