The Weekly Random Walk – March 25, 2024 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

March Madness

The NCAA Division I men’s basketball tournament is underway, with 68 teams now down to 34 by the time we post this. We have never been big on the bracketology that some like to play (we like watching F1 racing), but it’s an obsession for others.

After the FOMC meeting last Wednesday and listening to the very dovish comments from Chairman Powell, we believe some madness may exist inside their forward models. We are not PhDs, nor do we use their particular models (how did that do during the Great Financial Crisis or the Banking Crisis last year), but we look at what is in front of us, and their dovish stance doesn’t make sense (in our humble opinion).

Fast Break

Simon White of Bloomberg pointed out last week that monetary policy remains fast and loose, given one of the fastest-hiking cycles we have ever seen. This is seen by Fed Funds and SOFR (that replaced LIBOR), which show that future curves continue to steepen.

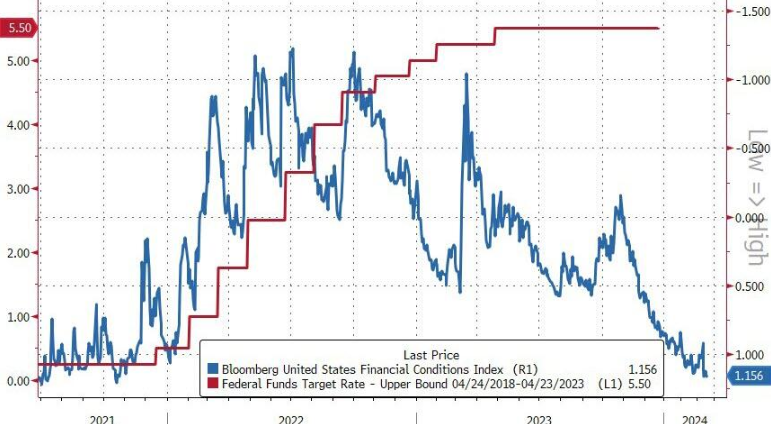

The FOMC held rates steady at 5.5% as expected and continued to project three rate cuts this year. But standing back and looking at the totality of monetary policy, it’s pretty easy to see that conditions did not tighten but loosened. To be clear, there was a tightening in mortgages for consumers, but that is offset by a robust equity market (asset inflation) and loose monetary conditions for banks and corporations.

If monetary policy were operating in the way expected (according to their models), one would expect to see more slack in the economy. Yet, this has failed to happen. The index of spare labor capacity, composed of the unemployment rate (U3) and productivity, is still close to a 50-year high.

If you wonder why we felt like inflation would reaccelerate early this year, outside of Fed Funds, financial conditions continued to ease, which made our call a simple one. We were proven correct.

“Nothing will work unless you do.” – John Wooden

The lack of concern about a reacceleration of inflation from Chairman Powell and the FOMC seems at odds with the “so-called” data we are reading.

Case in point: when we reviewed the US PMI price index, it showed a rise in costs, combined with strengthened pricing power from manufacturing amid the recent upturn in demand, which meant inflationary pressures are gathering strength in March. Costs have increased due to further wage growth and rising fuel prices, pushing overall selling price inflation for goods and services to its highest level in nearly a year.

The steep price jump from the recent low seen in January hints at unwelcome upward pressures on consumer prices in the coming months. So why was the Fed so dovish?

We are not the only ones confused by the Fed’s blind eye. The bond market has been watching the data after the hotter-than-expected February CPI print. Yields on the 2Y UST have risen in the last few weeks and are repricing to reflect the three cuts the FOMC signaled at their previous meeting. Disinflation is slowing, and some breakeven inflation levels are going up. For example, the 2-year breakeven inflation level climbed from 2.00% at the start of the year to 2.80% last week.

Halftime Adjustments

Last week, Goldman Sachs produced a research report from its economics team, which rightfully called out the Fed for their neutral rate argument on 2.0% inflation. We have stated for a while now that the Fed would probably be happy with an inflation target of 3.0-3.5% because of rising US deficits. So, it was nice to see a big economics team join us by saying the Fed needs to rethink its stated neutral rate.

As both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, Goldman’s team is now “penciling in a terminal rate of 3.25-3.50% this cycle, 100 bps above the peak reached last cycle.”

If and when the Fed concedes that the traditional 2% inflation target is higher (and will stay higher) than previously expected, we believe that’s a particular Rubicon that markets are not anticipating, and all bets will be off. But for now, Chairman Powell continues with his playbook (which equities believe) until “halftime adjustments” are warranted.

Well Beyond The Three-Point Line

We don’t envy the position of the Fed, which has to try and contain inflation in the face of lawmakers who spend money like it’s no tomorrow. Just last week, the House passed the 1.2 trillion dollar omnibus bill by a vote of 286-134, filled with more pork than the bacon aisle at Kroger. There is no such thing as fiscal conservatism in DC. It’s a thing of the past, but we digress.

To make matters worse (yes, much worse), the new Financial Report of the US Government signed off by Janet Yellen and the Treasury reports that Social Security and Medicare entitlements are underfunded (are you sitting down) by a whopping 175 TRILLION dollars! So, as a government, we are stumbling into government bankruptcy. So, with more printing ahead, the Fed is trying to pull a Steph Curry from well behind the three-point line to contain inflation (except they don’t have a high probability of hitting “nothing but net” like Steph does).

https://fiscal.treasury.gov/files/reports-statements/financial-report/2023/02-15-2024-FR-(Final).pdf

Demographics do not favor the current entitlement system as fewer birth rates in the US will inevitably change the delta on more people using the entitlement system than are putting in (hint: one reason why some in DC believe in open borders). It’s a massive shortfall and another reason why we think the Fed will live with higher inflation at the cost of consumers.

The great Milton Friedman said:

Inflation is the one form of taxation that can be imposed without legislation.”

Call A 30-Second Time Out!

As we return to the time machine and remember our Econ 102 days, remember there are two ways to get out of large government deficits.

Inflate your way out of deficits (we addressed that one)

Or grow your way out of deficits.

Starting in 1980, President Reagan laid the groundwork for higher growth carried forward by President Clinton, and if you remember, at the end of Clinton’s term, the US was running surpluses, and debt was going down.

As you look at the chart below, you’ll see that during the Reagan/Clinton era, consumers had a lot of room to spend as their debt (interest payments) was well below their earnings. However, after the Great Recession and a zero-bound Fed, consumers have taken on too much debt, and now, for the first time in history, personal interest payments (blue line) exceed wages (red line).

In no uncertain terms, this is not good and leaves us to believe that recession, consumer defaults, and bankruptcies are upcoming.

Zone Defense

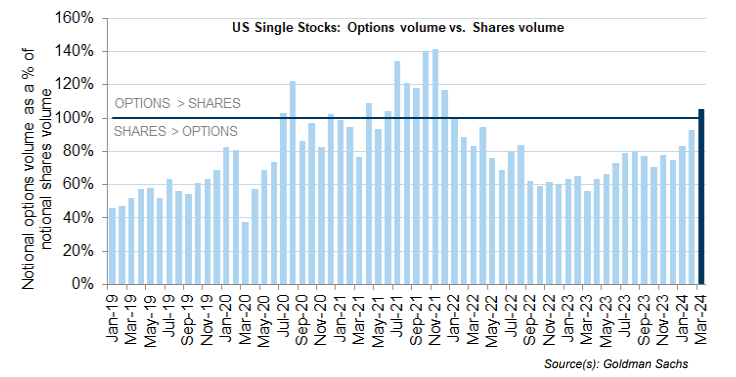

With equity markets making all-time highs, it’s been interesting to watch the derivatives market as single-name option volumes are now more than share volumes, driven at least partly by the growth of covered call ETFs and dispersion trading (selling index options and buying single-name options). Implied volatility remains low in the S&P 500, but volatility and volumes in many tech single names (i.e., SMCI, MSTR, COIN, NVDA, and AMD) are close to their highs, with implied vols in the 50-150% range.

We also note that S&P 500 volatility (VIX) is being suppressed because zero-day options allow daily hedging. In discussions with several large hedge fund managers over the last several weeks, they worry that when markets head lower, it may be difficult to extract “crisis alpha” from volatility because of the suppression.

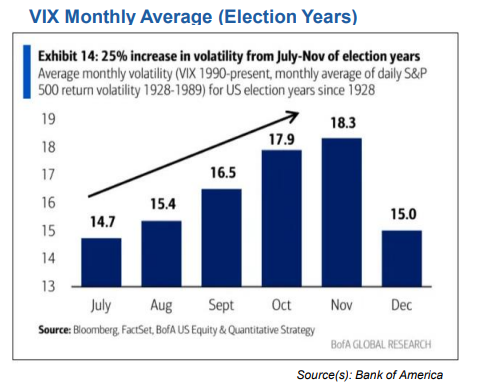

We have used volatility over many years as an “insurance policy” on large portfolio drawdowns. Any future success may be muted because of these single-day contracts. We continue to crunch numbers and, for now, maintain our position because the VIX monthly average during election years tends to move higher.

My Bracket Is Busted (Bullets)

There are tons of bullet points this week, but I am going to keep these short and sweet:

If you like chocolate, you’re about to pay a lot more as prices hit a record high of $8,600 per ton last week. Expectations are that cocoa prices could go higher as supplies are limited. We are headed to the grocery store now to stock up on Raisinets.

Restaurants are moving towards dynamic menu prices, increasing prices during peak times. This type of pricing (experienced with airlines and Uber) is now happening in major cities and could add to CPI in the coming quarters. With higher labor costs and food prices, restaurants will determine how to pass those prices on to consumers.

Blackrock got more bad news last week when the Texas Board of Education decided to pull 8.5 billion dollars from the asset manager firm due to a firm's boycott of energy firms (aka ESG agenda). We anticipate more of this as the curtain has been lifted on ESG.

Last week, we hit a milestone as the markets quietly passed history's longest continuous US 2s/10s yield curve inversion. That exceeds the 624-day inversion from August 1978, which previously held the record. As regular readers know, an inverted yield curve has been the best predictor of a US downturn of any variable throughout history and is a perfect 10 for 10 in US recessions (but let’s keep hoping for a soft landing).

Lastly, we should all expect a massive increase in our healthcare insurance in the coming years as the Committee on Homeland Security recently released a report estimating that it is costing over 450 billion dollars for healthcare for illegal immigrants. A large majority of these illegals are going to hospitals (if you haven’t been to an ER lately, go and see for yourself) and using them for primary care. Hospitals cannot deny service, and bills are not being paid because they have no insurance. We expect hospital care to increase as offsets to unpaid bills are moved to insurance companies and then to consumers.

There is no change in our thoughts on the equities right now. There is momentum to the upside, and with FOMO in full effect, investors may chase these indexes. We are now well beyond the median forecast for 2024 year-end targets with little upside on earnings. As markets increase, we urge more caution when investing new money.

There will be no update next week. I hope everyone has a blessed Easter.

Thank you for listening.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are those of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.